Silicones materials are not only an important component of new materials industry of the national strategic emerging industry, but also an indispensable supporting material for other strategic emerging industries.

With the continuous expansion of application fields, the huge demand potential has made silicones one of the most popular chemical materials at present.

The largest proportion of domestic silicones consumption is in fields such as construction, electronics, electricity and new energy, medical care, and personal care. Among them, the construction field is currently the main terminal scenario for the application of silicones, accounting for about 30%.

In addition to the continuous growth of demand for silicones materials in traditional industries, energy-saving and environmental protection industries such as photovoltaics and new energy, as well as the development of emerging industries such as ultra-high and ultra-high voltage power grid construction, intelligent wearable materials, 3D printing, and 5G, all provide new demand growth points for silicones.

Overview of Silicones

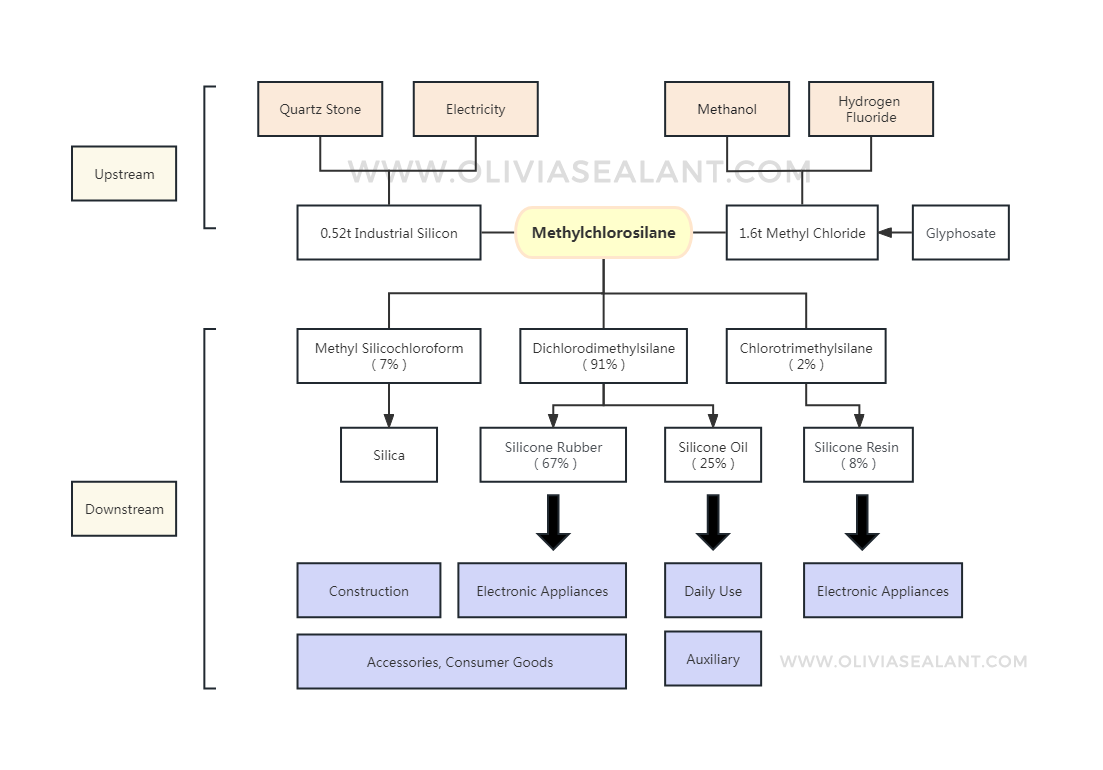

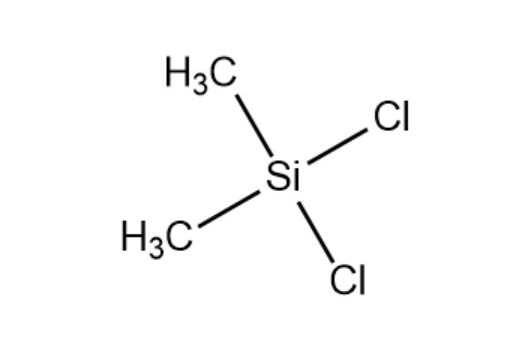

Silicones is a general term for silicon organic compounds, which are synthesized and hydrolyzed by metal silicon and chloromethane.

The first step in synthesizing silicones is to generate methylchlorosilane, which is then hydrolyzed to obtain monomethyltrichlorosilane, dimethyldichlorosilane, and trichlorosilane. Dimethyldichlorosilane is the main monomer variety of organic silicon, with its main downstream products being silicone rubber and silicone oil.

At present, the silicones production capacity mentioned in China generally refers to the production capacity of methylchlorosilane, while the current production statistics are all based on the production of dimethylsiloxane.

Silicones industry chain

The silicones industry chain is mainly divided into four links: silicones raw materials, silicones monomers, silicones intermediates, and silicones deep processing products. There are fewer production enterprises for raw materials, monomers, and intermediates, while downstream deep processing involves a wide range of products and more dispersed production capacity.

Silicone raw materials

The production process of silicones involves a large proportion of raw materials. The silicones raw material is industrial silicone powder, which is prepared in industry by reducing quartz with coke in an electric arc furnace.

The production of industrial silicone consumes a large amount of silicone ore and energy, and causes significant environmental pollution. Therefore, a stable and high-quality supply of industrial silicone raw materials has become the basic guarantee for silicones production.

According to SAGSI, in 2020, the global industrial silicone production capacity was 6.23 million tons, while China’s production capacity was 4.82 million tons, accounting for 77.4%.

Silicones monomers and intermediates

The domestic supply of silicones monomers and intermediates accounts for over 50% of the global total, making it the largest supplier of silicones monomers and intermediates in the world. Due to the unstable state of silicones monomers, companies generally synthesize the monomers into intermediates such as DMC (dimethylsiloxane) or D4 for sale.

There are few varieties and specifications of silicones monomers and intermediates.

Dimethyldichlorosilane is currently the most widely used silicones monomer, accounting for over 90% of the total monomer amount.

The entry threshold for the silicones industry is high, which has been raised to 200000 tons and requires at least 1.5 billion yuan of capital investment. The high industry entry threshold will promote the trend of monomer production capacity concentration towards leading enterprises.

At present, only a small number of companies have sufficient technological accumulation and achieved large-scale production, with over 90% of production capacity distributed among the top 11 enterprises.

The concentration of silicones monomer production capacity also provides more ample bargaining space for downstream enterprises.

In terms of supply, many leading silicones enterprises in China have ongoing projects or new plans. The new production capacity will be concentrated in production from 2022 to 2023, and the industry’s production capacity is about to enter a rapid expansion cycle.

According to data from Baichuan Yingfu, companies such as Hesheng Silicon Industry, Yunnan Energy Investment, and Dongyue Silicon Materials will invest approximately 1.025 million tons of silicones production capacity this year. Companies such as New Special Energy, Asia Silicon Industry, and Sichuan Yongxiang are also investing in polycrystalline silicon production capacity, driving an increase in industrial silicones demand.

SAGSI predicts that China’s production capacity of silicones methyl monomers will exceed 6 million tons/year by 2025, accounting for over 70% of the global production capacity of silicones methyl monomers.

According to C&EN, Momentive, foreign leading silicones company plans to close its silicones production capacity in Waterford, New York, making Dow the only manufacturer of silicones upstream raw materials in the United States

The global silicones monomer production capacity is transferred to China, and the industry concentration ratio will continue to improve in the future.

Deep processing of silicones

Deep processed silicones products often exist in the molecular form of RnSiX (4-n), and the stable physicochemical properties of the silicon chain and the variability of functional groups endow the deep processed silicones products with rich usage functions. The main products are silicone rubber and silicone oil, accounting for 66% and 21% respectively.

At present, the deep processing industry of silicones is still in a rapid development stage, with a relatively scattered industry. There are over 3,000 downstream deep processing enterprises only engaged in silicone processing.

The Structure of deep processed silicones products in China:

Overseas silicone companies lack a cost advantage in producing silicone monomers compared to Chinese companies, and most of the leading overseas silicone companies focus on developing downstream deep processing products and extending the industrial chain.

China’s encouragement policies for the silicones industry have gradually shifted from monomer production to deep processing of silicones products, development of new silicones products, expansion of new application fields, and improvement of comprehensive utilization level.

Silicones downstream products have higher product added value and market application prospects. At present, there is still significant room for development in the consumption of silicones in emerging markets in China and abroad.

Post time: Apr-20-2023